Attention all taxpayers! The IRS has just announced the annual inflation adjustments for 2025. It’s crucial that you stay up to date with these changes to ensure that you are filing your taxes accurately and effectively planning for your financial future. Don’t miss the chance to take advantage of these adjustments and stay ahead of your financial responsibilities. Stay informed and make the most of these updates for a successful year ahead.

It is absolutely imperative to have the correct tax numbers for the 2025 tax year. These numbers are specifically for preparing your 2025 tax returns in 2026, not for the previous year. Staying updated with the accurate tax information for each specific tax year is crucial to ensure that your filing is accurate. It is essential to have the right numbers for the right tax year to avoid any discrepancies. Make sure to keep yourself informed and use the official tax numbers for the 2025 tax year.

If you want to accurately estimate your tax liability for 2025, it’s important to consider any changes in your financial situation. Whether you’re expecting an increase or decrease in income, or if you’re planning any major life events such as marriage, starting a business, or having a baby, it’s crucial to adjust your withholding or estimated tax payments accordingly. By doing so, you can ensure that you won’t be caught off guard by unexpected tax burdens. It’s important to stay on top of these changes to avoid any surprises come tax time.

Tax Brackets and Tax Rates

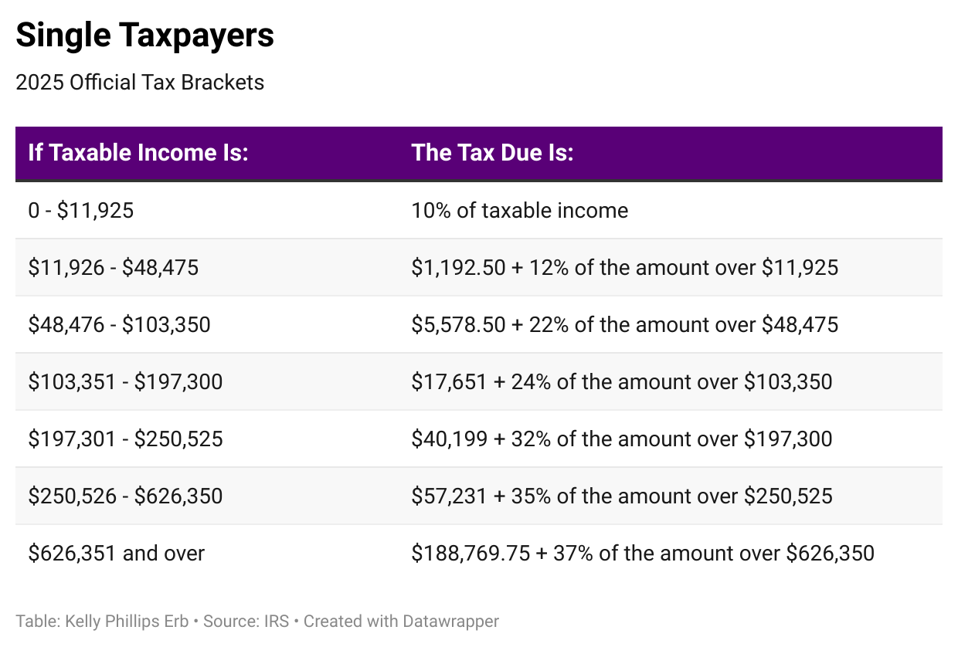

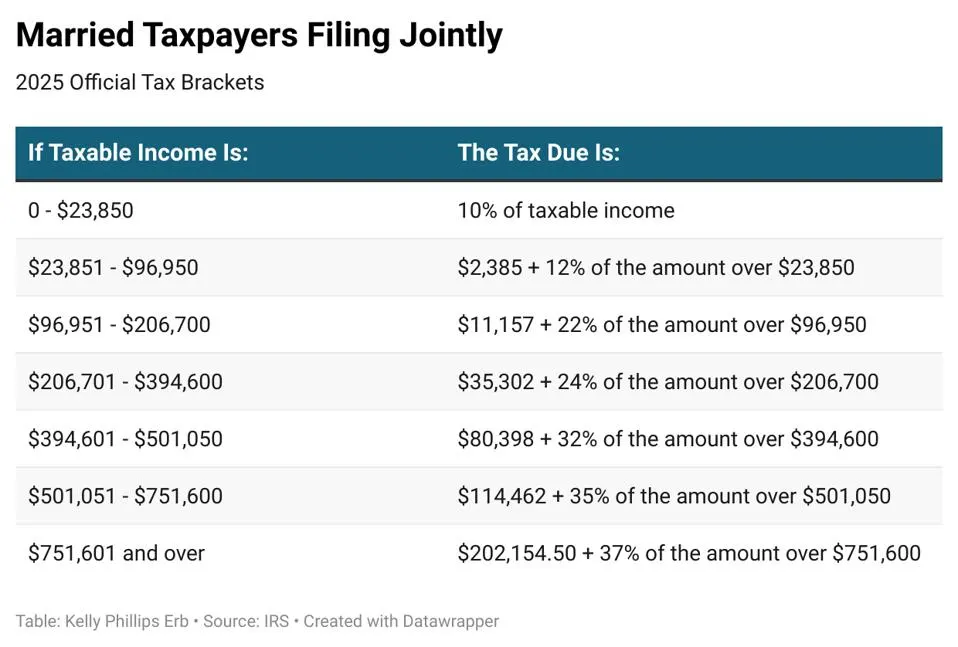

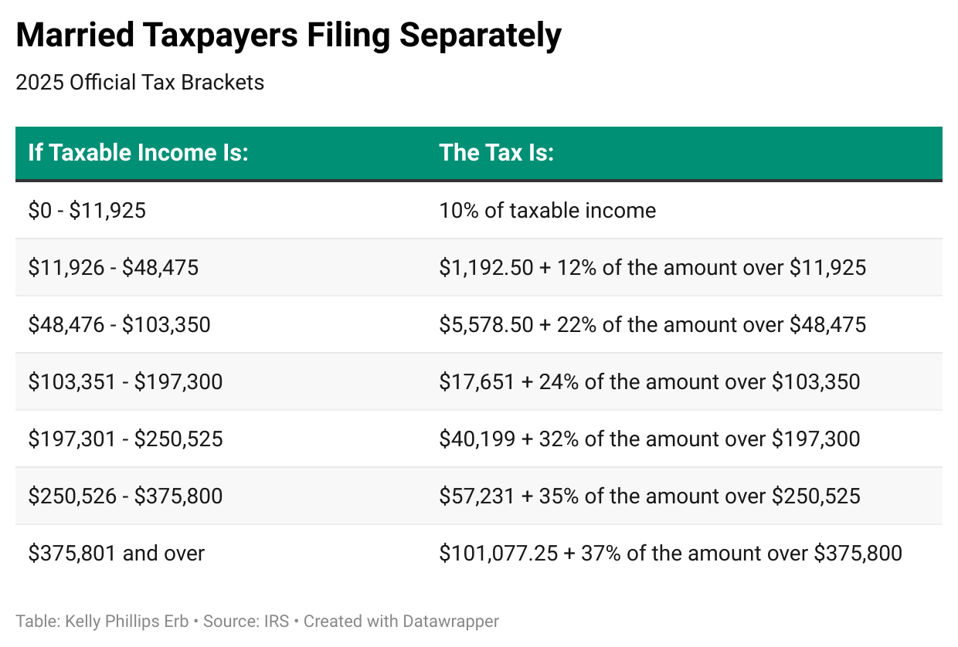

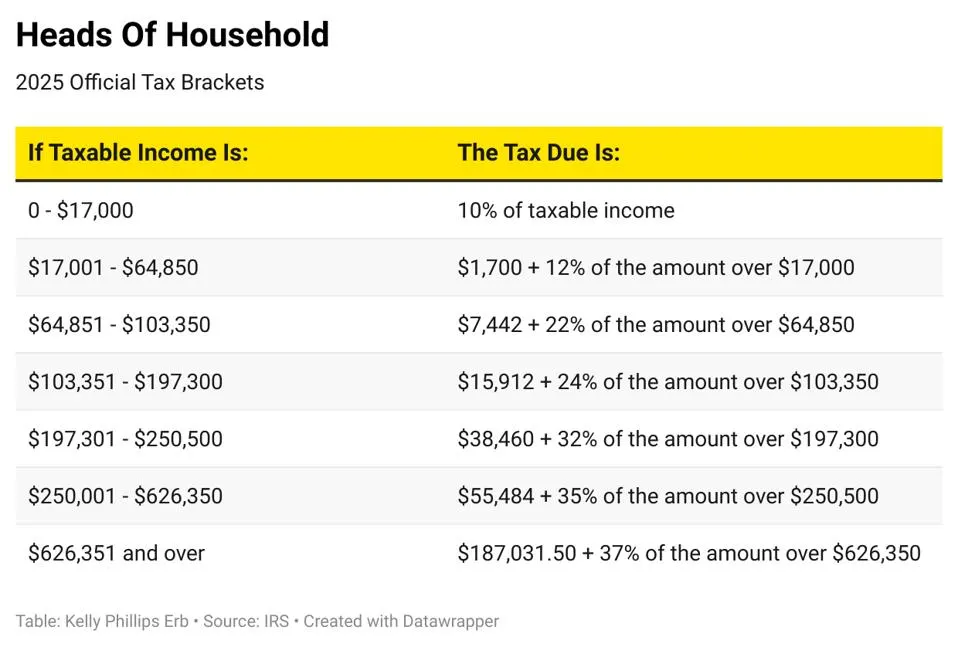

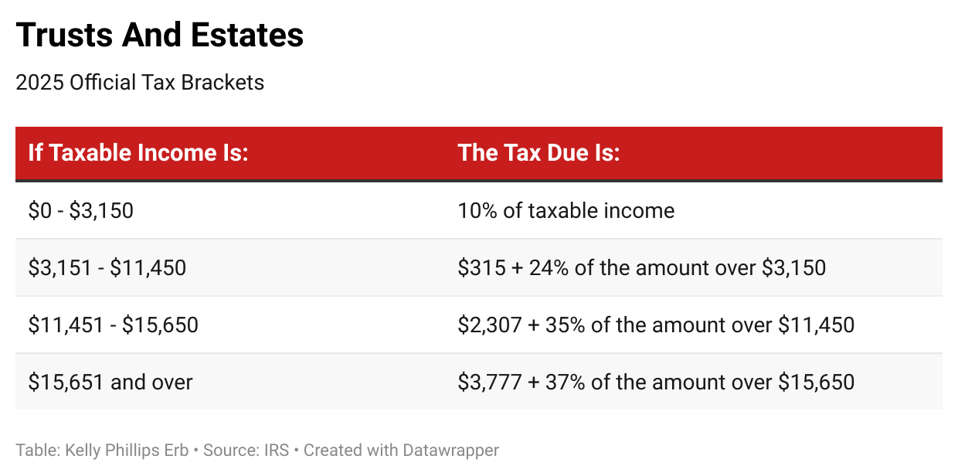

In 2025, it’s important to understand that the seven different tax rates are in place for a reason. These rates, ranging from 10% to 37%, serve specific purposes and are essential for maintaining a balanced and fair approach to taxation. It’s crucial to recognize the importance of each rate and how they contribute to the overall tax system.

Top Marginal Tax Rates

Knowing your marginal tax rate is essential in understanding how much of your hard-earned income is going towards taxes. For the 2025 tax year, the top tax rate is 37% for single individuals making over $626,350 and for married couples filing jointly with incomes exceeding $751,600. Being aware of your marginal tax rate allows you to make informed financial decisions and plan accordingly. Don’t let high tax rates surprise you, stay informed and take control of your finances.

The other rates are:

The current tax brackets for 2021 are carefully designed to ensure that those with higher incomes contribute a higher percentage of their earnings towards taxes. This system is crucial in creating a fair and equitable distribution of the tax burden, ensuring that those who have more resources contribute more to the functioning of our society. The progressive tax system allows for a more just and balanced approach, where those who earn more pay a higher percentage of their income in taxes. It’s essential that everyone pays their fair share and contributes to the common good.

Personal Exemption Amounts

Ladies and gentlemen, it is absolutely imperative that you take notice of the recent tax reform law of 2017. The elimination of personal exemption amounts has major implications for your taxable income. This means you will no longer be able to claim exemptions for yourself, your spouse, or your dependents. This provision is a critical aspect of the Tax Cuts and Jobs Act, and its expiration at the end of 2025 could have significant consequences for taxpayers. It is vital that you stay informed and understand how these changes may impact you and your financial situation.

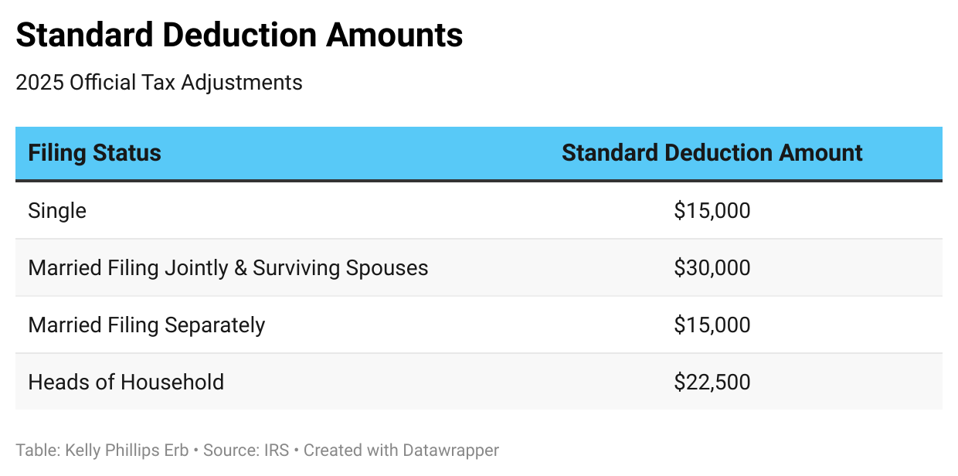

Standard Deduction Amounts

This is fantastic news for taxpayers! The standard deduction amounts are increasing for the upcoming year, which means more money in your pocket and less tax burden overall. For individuals and married couples filing separately, the standard deduction will be a generous $15,000, representing an increase of $400 from the previous year. Married couples filing jointly will benefit from a deduction of $30,000, an $800 increase from the previous year, while heads of household will see a jump to $22,500, a $600 increase from 2024. This is a win-win situation for taxpayers everywhere. So, be sure to take advantage of these increased deductions and keep more of your hard-earned money.

In 2025, the standard deduction for the aged or blind has been raised to $1,600, giving them a significant tax benefit. Additionally, unmarried taxpayers can now benefit from an increased standard deduction amount of $2,000. This means more money in your pocket and less tax liability. Furthermore, for individuals who may be claimed as a dependent by another taxpayer, the standard deduction amount cannot exceed $1,350 or the sum of $450 and the individual’s earned income, providing a fair tax benefit for all. It’s time to take advantage of these increased deductions and keep more of your hard-earned money.

Child-Related Adjustments

The kiddie tax is a tax that applies to unearned income for children under the age of 19 and college students under the age of 24, including income from sources other than wages and salary, such as dividends and interest.

If your child has unearned income in 2025 that is more than $1,350 but less than $13,500, you may have the option to include that income on your own tax return rather than filing a separate return for your child.

The same rules for earned income apply as well, so it’s important to be aware of how these tax regulations may affect your family’s financial situation.

There is currently discussion in Congress about potential changes to the Child Tax Credit, but as of now, no action has been taken. If no changes are made, the maximum amount of the child tax credit that may be refundable will be $1,700 in 2025. It’s important to stay informed and be prepared for any potential changes to tax laws that may impact your family. Stay informed and be prepared for any potential changes to tax laws that may impact your family.